By Ryan O’Donnell, CFP® and Mike O’Donnell, CFP®

Equities

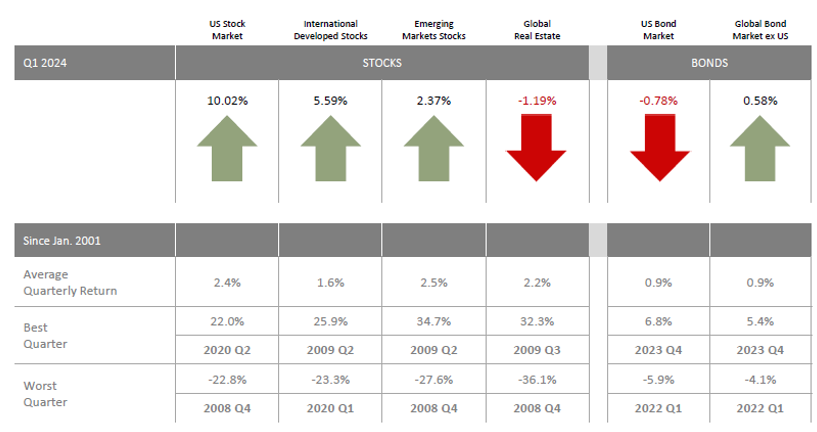

Buoyed by relatively strong economic news, low volatility, signs of inflation slowing and expectations of Fed rate cuts on the horizon, U.S. stocks had one of the strongest first quarters in recent memory. U.S. equities gained over 10% in Q1 and posted a +29.29% return for the past 12 months. Notably, the rally spread to other non-tech sectors. U.S. stocks easily outperformed international and emerging stocks, as well as global real estate, U.S. bonds and global bonds for both the quarter and the past 12 months (see chart below). Meanwhile, U.S. bonds lagged most other asset classes as interest rates rose and the Federal Reserve remained on pause regarding planned cuts to interest rates.

Index Returns

Long-Term Market Summary

A closer look at U.S. equities

While U.S. equities performed extremely well across the board, value underperformed growth, small caps underperformed large caps and REIT indices underperformed equity market indices (see chart below).

U.S. REITs still outperforming global REITs

U.S. REITS held steady after an extremely strong Q4 in 2023, generating a Q1 return of -0.39%. While somewhat disappointing, U.S. REITs outperformed non-US REITs by over 200 basis points (-0.39% vs. -2.43%) as well as most other fixed income asset classes in Q1. As with most real estate investments, REITs are highly interest rate sensitive. When the rate tightening cycle officially ends, REITs tend to perform well on an absolute and relative basis. After the Fed has reached rate stabilization, REITs historically return 20%+ over that next 12 months.

Fixed income

Unlike equities, bonds underperformed during Q1 as signs of more persistent inflation and stronger-than-expected economic growth led investors to price in fewer Fed rate cuts than what was expected at the beginning of the year. From where we sit, the big headline for fixed income in Q1 was how U.S. economic data continued to show resiliency and strength despite the highest interest rates in 40 years. This has caused rates to rise after falling sharply in the latter part of last year. For instance, the two-year U.S. treasury yield rose roughly 50 basis points during the quarter.

Expectations for the Fed to cut interest rates peaked at the beginning of the year with many expecting at least half a dozen cuts in 2024. Now, with two Fed meetings and stronger economic growth behind us, the consensus is for two or three cuts at best. If you’re keeping score at home, the last rate hike was nine months ago, (July 2023). Nine months is longer than the historical interval between the last hike to the first cut -- but not unprecedented. Many expect the Fed to change direction at some point between now and the November elections, but when and by how much is anyone’s guess.

As yields rose across the Treasury curve during the first quarter, bond prices fell. The Bloomberg Aggregate Index, a broad measure of the bond market, declined as a result. The bond market dropped slightly in the first quarter, down 78 basis points. With the time horizon for rate cuts being pushed out, it may likely be another year in which fixed income returns are mostly on the back end. Again, you’ll want to stay well-diversified both in terms of duration and asset classes in general.

Inverted yield curve and recession risk

The US. Treasury Yield Curve has been inverted since October 2022 – that’s when yields on short-term instruments exceed yields on long-term instruments. Many economists and market watchers believe an inverted yield curve signals a forthcoming recession, since a yield curve inversion has preceded all six U.S. recessions since 1976. But an inverted yield curve does not necessarily mean a recession is imminent. We are now going on over 18 months since the first inversion of the 10-year/2-year Treasury curve – the longest interval without a recession in over 50 years. That doesn’t guarantee the U.S. economy has achieved a “soft landing,” but the odds of the U.S. economy entering a recession within the next 12 months have now fallen to a two-year low of 33%, according to Bankrate’s latest quarterly economists’ poll. Compare that to 65% back in Q3 of 2022. Meanwhile, a Bloomberg survey of forecasters reduced their consensus recession odds to 40% in 2024, the lowest level since 2022.

As Paul Samuelson famously quipped: “Economists have successfully predicted nine out of the last five recessions.”

We continue to talk with clients about the benefits of earning interest on idle cash that may be sitting in your personal bank account or business. We have an extensive cash management solution to help our clients earn 5%+ on idle cash. Give us a call for more details (530) 564-0960

Looking ahead

It’s no secret that the stock market rally since October 2023 has been fueled by the technology sector, particularly the “Magnificent 7” mega-cap stocks (Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms and Tesla). However, as Wes Crill, PhD, Senior Investment Director and Vice President, Dimensional Fund Advisors explains at the end of this report, the “moat” these deep- pocketed companies have built around their businesses can’t last forever.

“Think about the state of mobile phones 15 years ago,” wrote Crill. “In all likelihood, you would have been reading this on a BlackBerry, such was that device’s entrenchment for mobile business communication. Then, along came iPhones and Androids and suddenly BlackBerry’s foothold was eroded.” As Crill recounted, it wasn’t all that long ago that Sears was a Top 10 stock, AOL was synonymous with internet access in the 1990s and 20 years ago, Friendster (not Facebook) was the most popular social media network.

“Even the biggest companies have uncertain futures, highlighting the need for broadly diversified investments,” advised Crill. “And even if these companies stay at the top of the market, that’s no assurance higher returns will continue if their success is expected.”

As always, it pays to be well-diversified. You never know which company, asset class, or sector will outperform and which will underperform. As the old saying goes: “Time in the market always produced better outcomes than timing the market.”

We are always available to meet with you or to discuss ideas. Please contact us HERE to schedule a quick meeting with either Mike or Ryan.